-

Welcome To Damiina E-learning

-

Module 1: Introduction to Cryptocurrency

-

Module 2: Understanding Blockchain Technology

-

Module 3: Introduction to Airdrops, Tokens, and Coins

-

Module 4: Cryptocurrency Wallets, Top Exchange Centers, and Security

-

Module 5:GETTING STARTED WITH CRYPTO TRADING

-

MODULE 6: TYPES OF TRADE ON BINACE

-

MODULE 7: MEMCOIN

-

MODULE 8: TRADING PSYCHOLOGY

-

MODULE 9: NFT (NON-FUNGIBLE TOKENS)

Crypto Chart Patterns and Time Frame

Time Frames in Crypto Trading:

- Long-Term (for Investors):

- Weekly (W): Big picture view, track long-term trends.

- Monthly (M): For long-term investors, very broad trend analysis.

- Medium-Term (for Swing Traders):

- Daily (D): Tracks daily trends, good for swing trades.

- 4-Hour (4H): Shorter trends, helps in making trades lasting a few days.

- Short-Term (for Day Traders/Scalpers):

- 1-Hour (1H): Short-term trades, captures quick price moves.

- 30-Min (30M): More detailed for short-term trades within a day.

- 15-Min (15M): Quick decisions for day trades.

- 5-Min (5M): Ultra-short-term, quick trades.

- 1-Min (1M): For scalpers, very rapid trades.

Choosing the Right Time Frame:

- Shorter Time Frames: For quick trades (scalping/day trading).

- Medium Time Frames: For swing traders, capturing trends over a few days.

- Longer Time Frames: For long-term investors, focusing on overall market direction.

Chart Patterns

Chart patterns are visual formations created by the price movements of a cryptocurrency on a chart over time. These patterns are used to forecast future price movements based on past behavior.

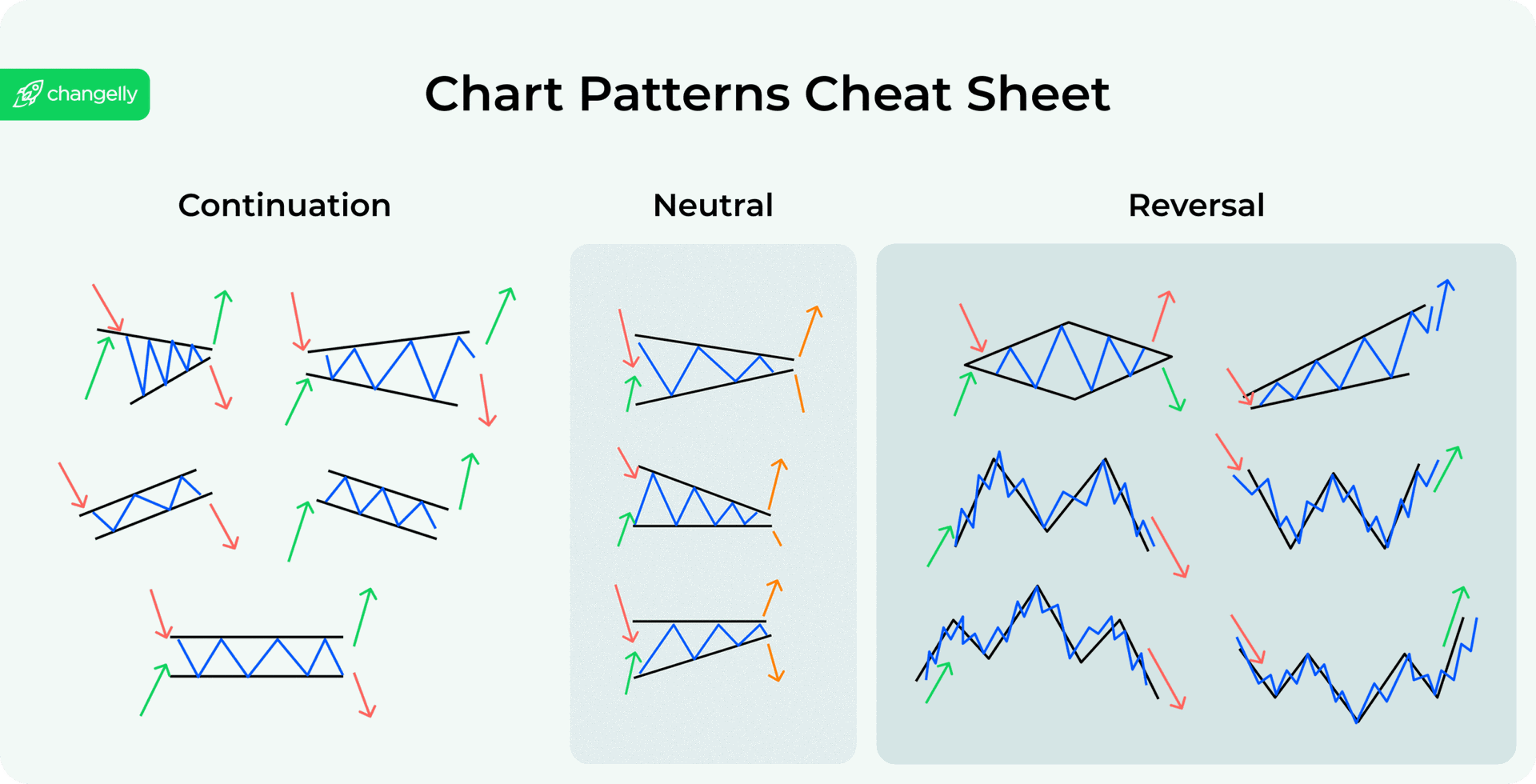

Types of the chart pattern:

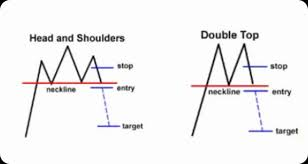

Reversal Patterns: Indicate a change in the trend direction. Examples: Head and Shoulders, Double Top/Bottom and rising wedge.

Continuation Patterns: Indicate the trend will continue in its current direction. Examples: Triangles, Flags, Pennants.

Rating

1

0

There are no comments for now.